CASSIAR NORTH – BULK-TONNAGE RESOURCES/TARGETS

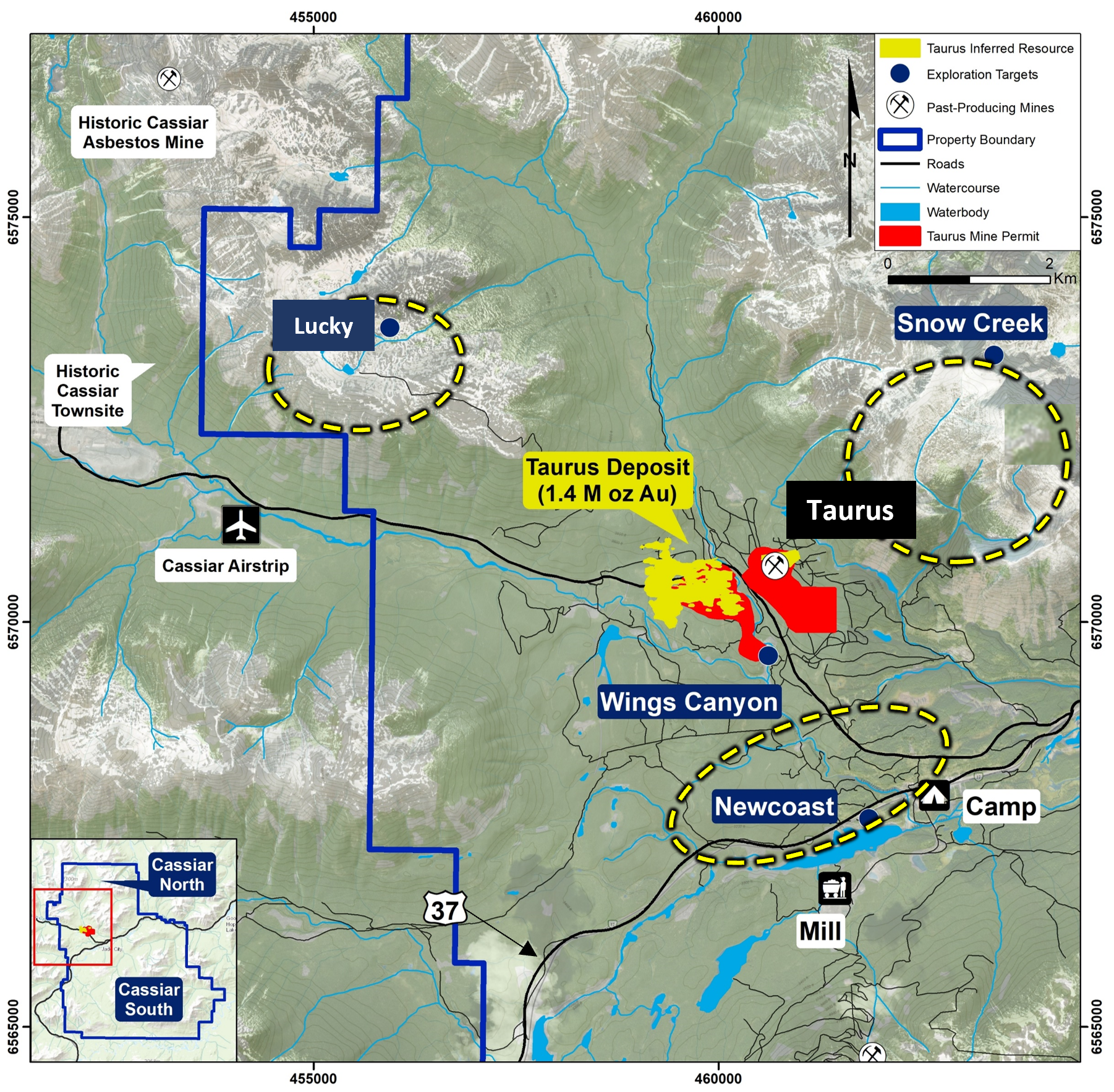

The Cassiar North project area hosts the Taurus Deposit as well as multiple bulk-tonnage-style regional targets including the Wings Canyon, Snow Creek and Newcoast prospects. The project area also includes the Lucky high-grade vein prospect.

TAURUS DEPOSIT RESOURCE ESTIMATE

The Taurus Deposit contains an NI43-101 Inferred Resource of 1.4Moz at 1.14 g/t gold using a 0.50 g/t Au cut-off*

| Taurus Deposit Inferred Mineral Resource Estimate at a Cut-off Grade of 0.50 g/t Au with Grade Sensitivity of Estimated Grades within the Pit Shell, effective April 28, 2022* | |||

| Au g/t Cut-off | Tonnes | Au (g/t) | Au (oz) |

| 0.40 | 44,600,000 | 1.03 | 1,480,000 |

| 0.50 | 37,900,000 | 1.14 | 1,390,000 |

| 0.60 | 32,000,000 | 1.24 | 1,280,000 |

| 0.70 | 27,000,000 | 1.36 | 1,180,000 |

| 0.80 | 23,000,000 | 1.46 | 1,080,000 |

HISTORY & EXPLORATION

The Taurus Deposit has seen past production of 35,000 oz at a recovered grade of 3.8 g/t Au at the Taurus underground mine from 1981-1988 (Historical production figures from Taurus MINFILE Production Detail Report, file number 104P 012, BC Geological Survey.).

Recent exploration began in 2019 when Margaux Resources (predecessor to Cassiar Gold) conducted geological mapping and prospecting of both new and known gold prospects on the Property. Although the Property has an extensive exploration history, much of the historical work has targeted high-grade veins, and not lower-grade occurrences that may have bulk tonnage potential. To that end, geological mapping, chip and grab sampling, as well as resampling of one historical drill hole core, were done on numerous prospects in both the Taurus and the Table Mountain areas. Rock samples were simple “grab” samples, while chips were taken across veins and alteration areas.

In 2020, Cassiar Gold completed a 5,000-metre drill program which successfully extended mineralization between past drill holes to confirm continuity of mineralization. In 2021, Cassiar Gold completed another drill program consisting of 15 holes totaling 4,098 m which was aimed at defining and/or confirming higher-grade mineralized areas where historical drilling was widely spaced. Results were encouraging.

MINERALIZATION STYLES

At the Taurus Deposit, mineralization consists primarily of basalt-hosted low-sulfide gold-bearing veins (“T4” type mineralization), which have well-defined alteration envelopes of quartz-sericite-iron carbonate and pyrite. Shear veins, extensional veins, thrust-filling veins, as well as vein arrays and breccia zones all occur, but shear veins are the most economically significant in terms of gold mineralization.

Coarse gold may be present in any of the vein types and can cause a pronounced nugget effect in sampling. A second, less-common type of mineralization consists of semi-massive to massive, fine-grained auriferous pyrite (“T3” type mineralization), such as at the Taurus West zone. T3 mineralization is interpreted as early, replacement-style mineralization.

Shear veins average 1 to 2 m in width, but locally can blow out to over 10 m wide or be as narrow as several centimetres. Shear veins may be massive or banded with seams of quartz, carbonaceous material, sulfides or tourmaline. Sulfides consist of pyrite, arsenopyrite, tetrahedrite, sphalerite and chalcopyrite in decreasing order of abundance. Early barren shear veins are devoid of sulfides. Shear veins are steeply dipping to near-vertical veins. In general, veins in the southern part of the property dip to the north, while those in the northern part of the property have steep south dips.

STATUS

Today, the Taurus deposit remains open laterally in most directions and at depth, providing the potential for expansion of the resource and additional discoveries through further exploration.

* Source: Zelligan, Moors, Jolette, April 28, 2022. NI43-101 Technical Report on the Cassiar Gold Property, prepared for Cassiar Gold Corp.